State Small Business Credit Initiative (SSBCI)

CRF – A PREFERRED SSBCI PARTNER

We are your SSBCI implementation partner for your SSBCI credit programs

Proven model for previous state loan funds

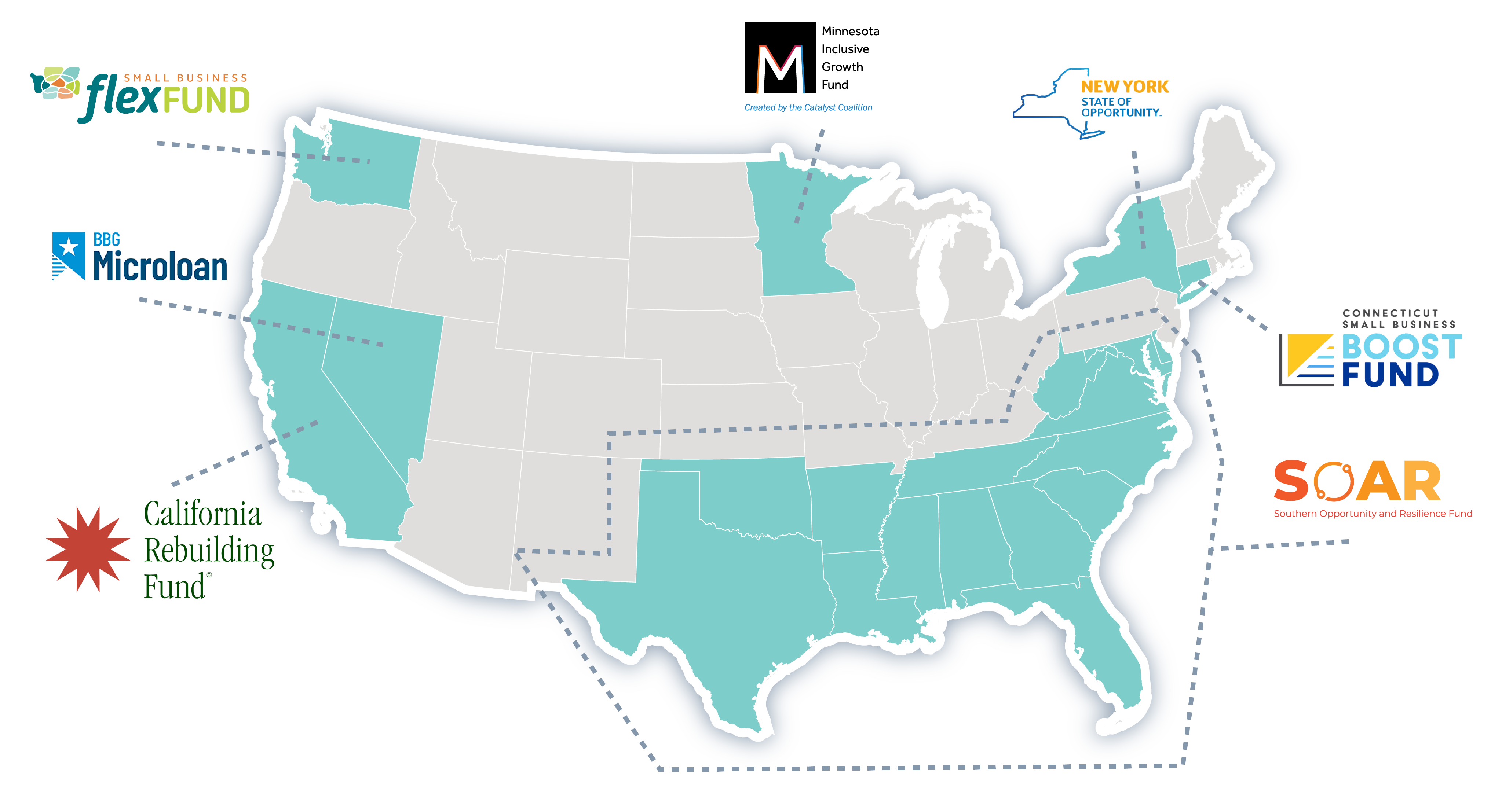

In response to the pandemic, Calvert Impact, CRF, NDC and their partners built and implemented an innovative loan participation fund structure that has been implemented and is active across 19 states and the District of Columbia (“LPP 1.0”).

SSBCI Loan Participation Program

A turnkey model for loan participation programs

Together with our partners Calvert Impact and the National Development Council (NDC), we have developed and are implementing a turnkey loan participation program available nationally to all states. The program is Treasury approved and meets all Treasury requirements.

What is the model?

The national model is based on the state/regional model the three organizations developed in response to the pandemic and have used and implemented across 19 states and the District( “LPP 1.0”).

It utilizes a fund structure, technology supplied by CRF, a private warehouse line of capital, fund administration provided by CRF or NDC, financing and operational support by Calvert Impact.

Advantages of the turnkey national model for SSBCI:

-

Proven record of reaching small businesses, particularly SEDI and VSB as defined by the Treasury

-

Fully managed turn-key program, simplifies reporting and administration for the states

-

Utilizes CRF Connect and CRF Exchange

-

Committed and assured source of private capital

-

Simplify the process for the small business owners

-

Ability to support local CDFIs and if needed provide access to additional CDFI lenders

SSBCI Solutions for Technology, Lending, Reporting

Support with technology, lending, and/or reporting and SSBCI administration

Our established technology model for scaling capital and providing back-end support for small business recovery loan funds includes:

-

Program onboarding & training

-

Industry leading security and bespoke program architecture

-

Marketing and digital support available

-

API connections to seamlessly transfer & connect program data

Intake and matching platform

-

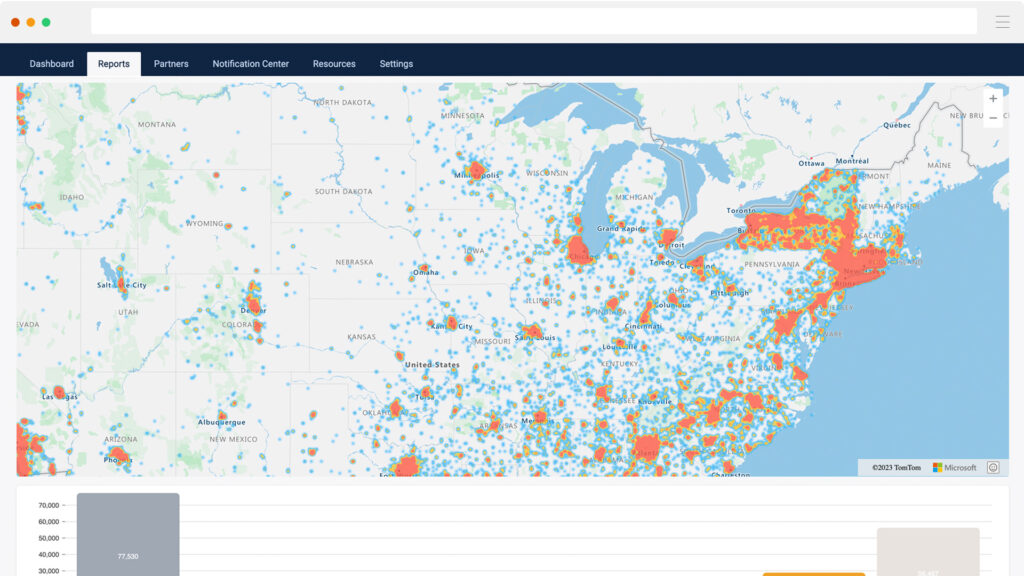

Simple, web-based pre-application form to capture, aggregate, & distribute demand to partners

-

Match to loan, grant, and technical assistance opportunities to ensure service & access, even for applicants who aren’t loan ready

-

Customizable form to gather program-specific data and impact metrics

-

Provides equitable access to SSBCI programs for broad impact

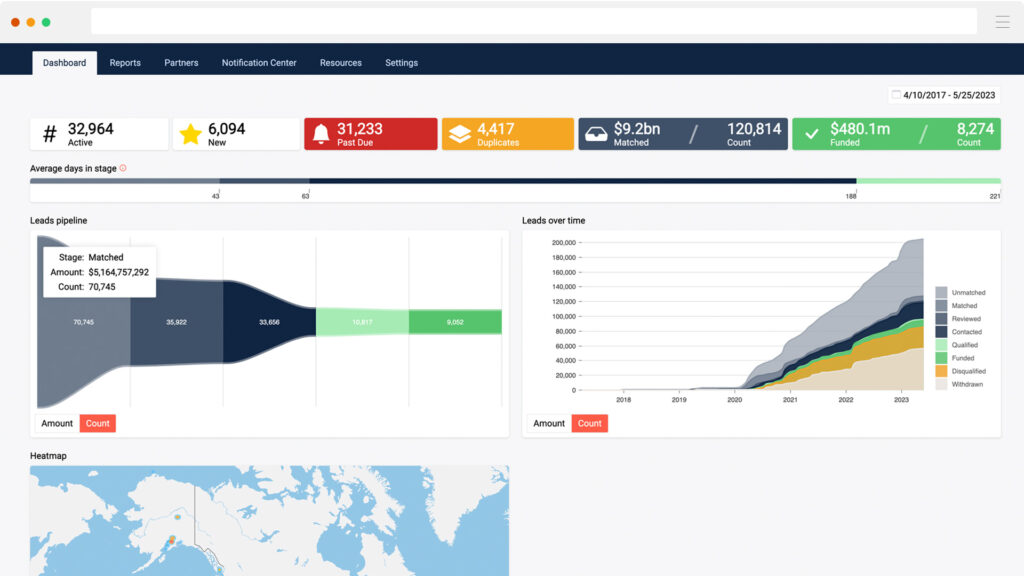

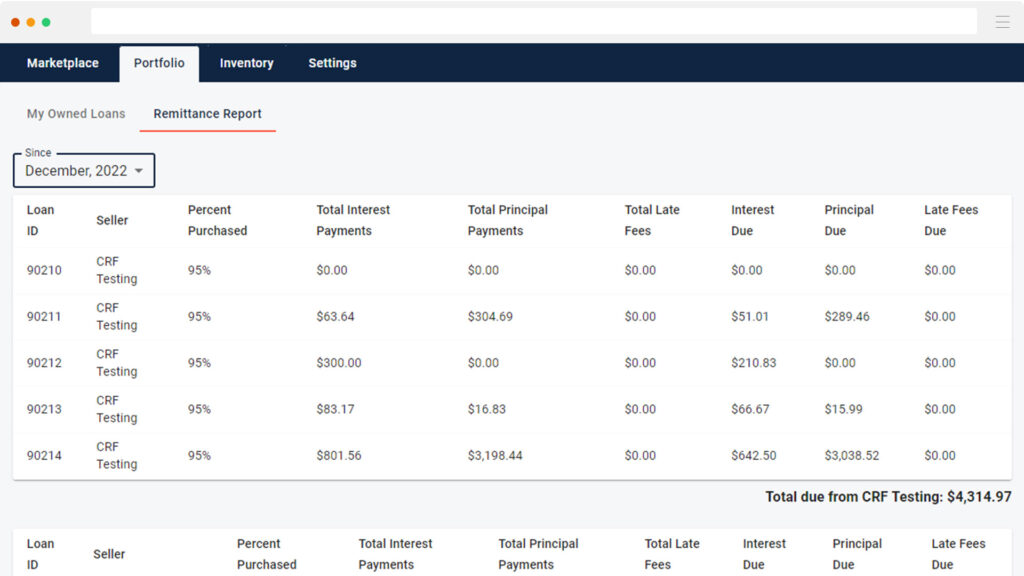

Reporting, Compliance, & Liquidity Platform for SSBCI participants

-

Document capture & retention for accountability and audit purposes

-

Reporting customization, data standardization, and validation tools

-

Real-time program dashboards

-

Tech-enabled sales to program fund when used for liquidity solutions

Explore more SSBCI topics

SSBCI Success Story