State Small Business Credit Initiative (SSBCI)

CRF – A PREFERRED SSBCI PARTNER

We are your SSBCI implementation partner for your SSBCI credit programs

Proven model for previous state loan funds

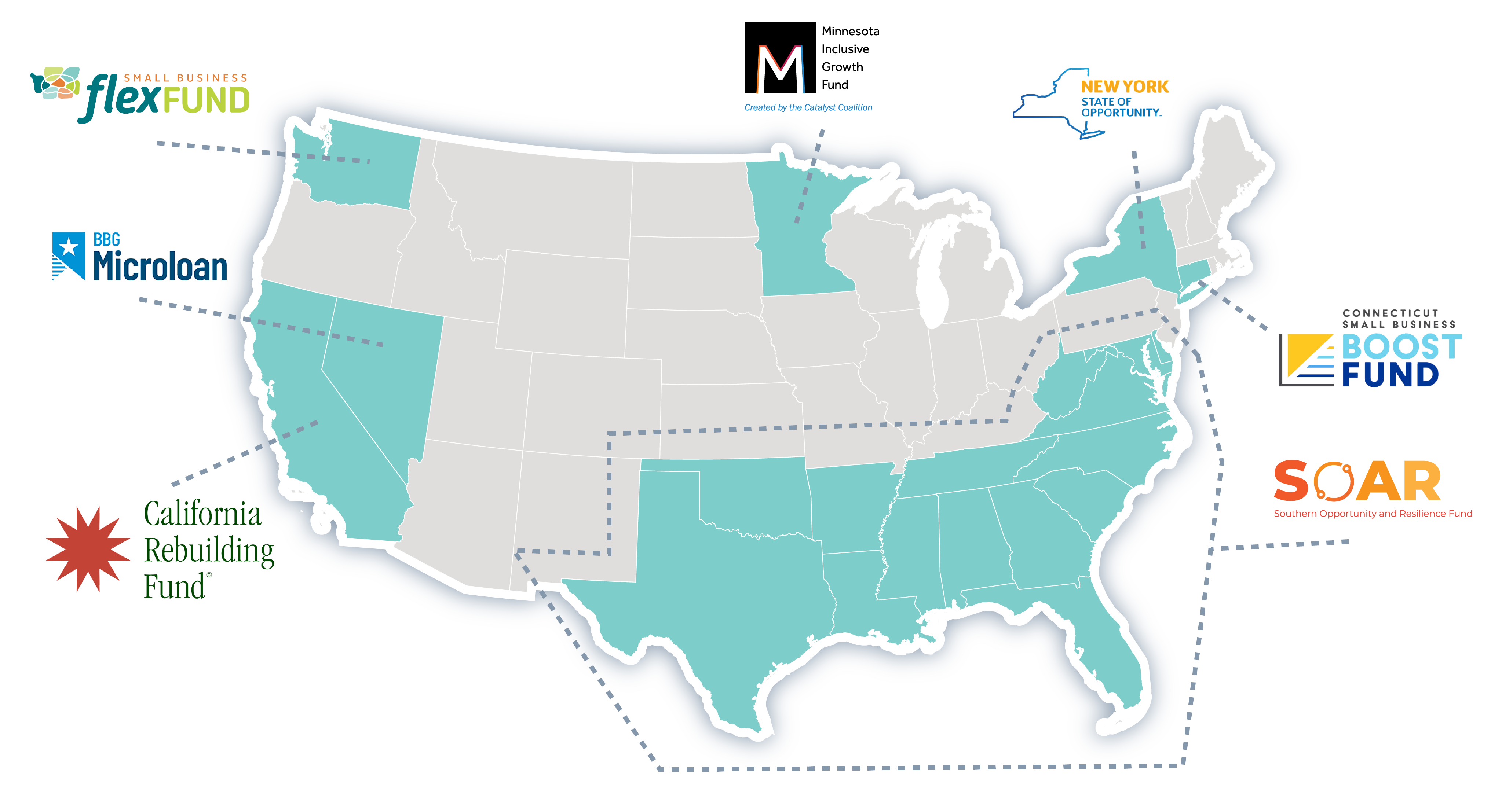

In response to the pandemic, Calvert Impact, CRF, NDC and their partners built and implemented an innovative loan participation fund structure that has been implemented and is active across 19 states and the District of Columbia (“LPP 1.0”).

SSBCI Loan Participation Program

A turnkey model for loan participation programs

Together with our partners Calvert Impact and the National Development Council (NDC), we have developed and are implementing a turnkey loan participation program available nationally to all states. The program is Treasury approved and meets all Treasury requirements.

What is the model?

The national model is based on the state/regional model the three organizations developed in response to the pandemic and have used and implemented across 19 states and the District( “LPP 1.0”).

It utilizes a fund structure, technology supplied by CRF, a private warehouse line of capital, fund administration provided by CRF or NDC, financing and operational support by Calvert Impact.

Advantages of the turnkey national model for SSBCI:

SSBCI Solutions for Technology, Lending, Reporting

Support with technology, lending, and/or reporting and SSBCI administration

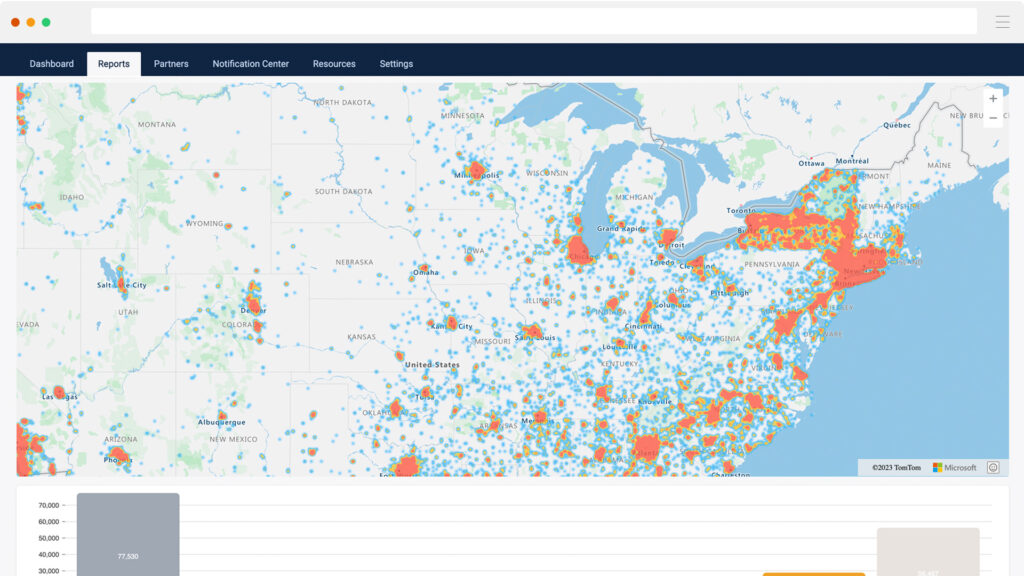

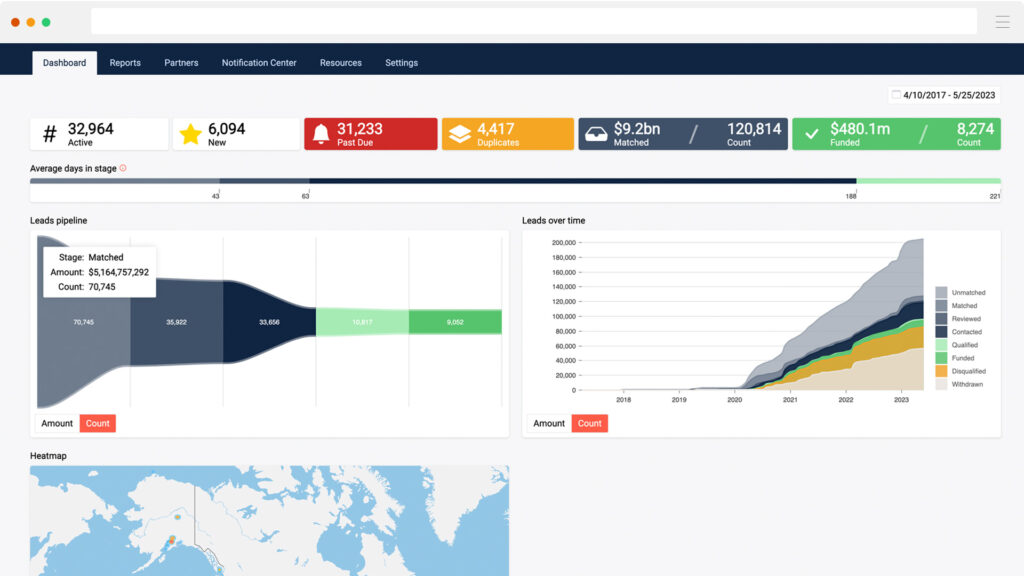

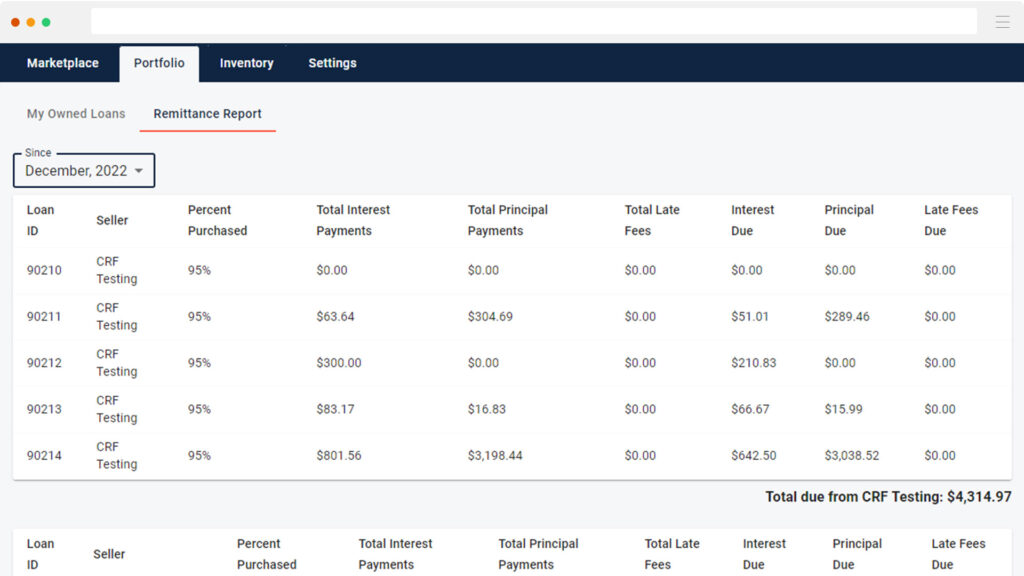

Our established technology model for scaling capital and providing back-end support for small business recovery loan funds includes:

Explore more SSBCI topics

SSBCI Success Story

Nevada Battle Born Program

Ready to Chat?

General Fax: 612.338.3236

Loan Servicing Fax: 612.359.6185

EIN: 41-1616861

NMLS ID: 310577

Founded in 1988, Community Reinvestment Fund, USA (CRF) is a national non-profit organization with a mission to improve lives and strengthen communities through innovative financial solutions. CRF has injected more than $3.6 billion to stimulate job creation and economic development and support community facilities.